It’s hard to get excited after seeing the recent performance of MACOM Technology Solutions Holdings (NASDAQ:MTSI), whose shares have fallen 11% over the past week. However, stock prices are often driven by a company’s long-term financial performance, which in this case looks promising. Specifically, we decided to study the ROE of MACOM Technology Solutions Holdings in this article.

Return on Equity, or ROE, is a test of how effectively a company increases its value and manages investors’ money. In other words, it reveals the company’s success in turning shareholder investment into profit.

Our analysis shows that MTSI may be undervalued!

How is ROE calculated?

Return on Equity can be calculated using the following formula:

Return on Equity = Net Profit (from Continuing Operations) ÷ Shareholders’ Equity

Therefore, based on the above formula, the ROE of MACOM Technology Solutions Holdings is:

37% = $218M ÷ $596M (based on trailing 12 months ending July 2022).

“Return” is the income earned by the business in the past year. One way to conceptualize this is that for every $1 of shareholder capital owned, the company makes $0.37 in profit.

What is the relationship between ROE and earnings growth?

We have determined that ROE can be a useful profitability indicator for measuring a company’s future earnings. Based on how much profit a company chooses to reinvest or “keep”, we can assess the company’s ability to generate profits in the future. In general, other things being equal, companies with high return on equity and profit retention have higher growth rates than companies without these attributes.

MACOM Technology Solutions Holdings Earnings Growth and 37% ROE

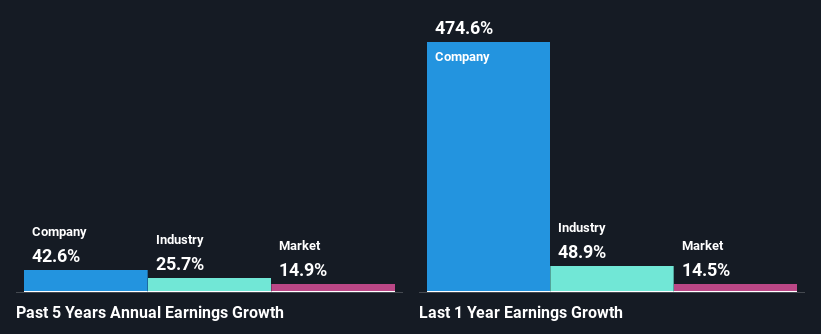

First, we like that MACOM Technology Solutions Holdings has an impressive ROE. Second, we also note this when compared to the industry-reported average ROE of 19%. Therefore, it is not surprising that MACOM Technology Solutions Holdings has achieved a substantial net income growth of 43% over the past five years.

Second, when compared to industry net income growth, we find that MACOM Technology Solutions Holdings’ growth is quite high compared to the industry average growth of 26% over the same period and is well worth a look.

Earnings growth is an important metric to consider when evaluating a stock. It’s important for investors to understand whether the market has already priced in a company’s expected earnings growth (or decline). By doing this, they’ll know if the stock is going into clear blue waters, or if it’s waiting for swampy waters. Is the value of MTSI reasonable? This infographic about a company’s intrinsic value contains everything you need to know.

Is MACOM Technology Solutions Holdings making efficient use of its profits?

Given that MACOM Technology Solutions Holdings does not pay any dividends to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

in conclusion

Overall, we are very pleased with the performance of MACOM Technology Solutions Holdings. In particular, it’s good to see that the company has invested heavily in its business, accompanied by high returns, which have led to a substantial increase in its earnings. Having said that, after examining current analyst estimates, we are concerned that the company has seen earnings growth in the past, but analysts expect its earnings to shrink in the future. Are these analyst expectations based on broad industry expectations, or are they based on the company’s fundamentals? Click here to go to our analysts’ forecasts for the company page.

Have feedback on this article? Care about content? keep in touch Contact us directly. Alternatively, email the editorial team (at) simplewallst.com.

This article by Simply Wall St is general in nature. We provide commentary based solely on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to provide financial advice. It does not constitute advice to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analytics driven by fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Wall Street has no positions in any of the stocks mentioned.

Valuation is complicated, but we’re helping make it simple.

find out if MACOM Technology Solutions Holdings May be over or underestimated by viewing our comprehensive analysis, which includes Fair Value Estimates, Risks and Warnings, Dividends, Insider Trading and Financial Condition.

View free analysis